Labor Code Section 226

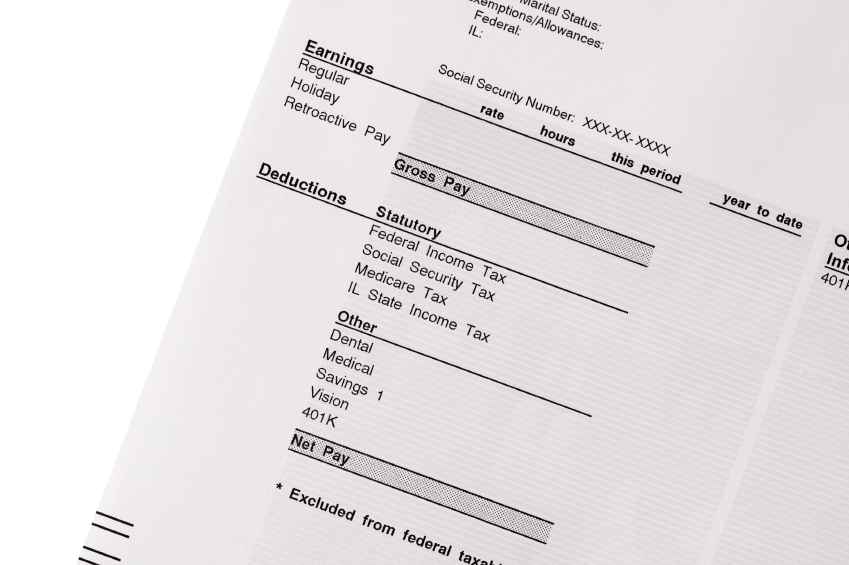

Under California law, employers are required to provide hourly employees with an itemized pay stub (wage statement) that includes the following information on each pay stub:

- Gross wages earned;

- Total hours worked;

- All deductions;

- Net wages earned;

- The inclusive dates of the period for which the employee is paid;

- The name of the employee and only the last four digits of his/her Social Security Number and/or Employee ID number;

- The name and address of the legal entity that is the employer;

- All applicable hourly rates in effect during the pay period and corresponding number of hours worked at each hourly rate by the employee; and

- (For temporary service assignments) The rate of pay and total hours worked for each temporary services assignment.

Penalties For Violation Of Labor Code Section 226

An employer's failure to provide pay stubs to its employees that are in compliance with the above-described requirements can result in significant statutory and civil penalties against the employer.

Are Your Pay Stubs Accurate?

If you believe that your pay stubs are not in compliance with Labor Code Section 226, Contact Sani Law today to schedule a free initial consultation. We will aggressively pursue compensation from employers that fail to follow the law.